Kenya: Acorn Affordable Student Housing

Investing in housing for the future

Challenge

The Government of Kenya is committed to upskilling the country’s workforce, driving an increased number of enrolments at Kenya’s public universities and colleges. However, as student numbers have increased, universities have found it difficult to meet demand for on-campus student accommodation. With only around 23% of students securing accommodation though their institution of study, there has been a rise in the use of off-campus accommodation such as hostels where poor security, overcrowding and inadequate sanitation are common. The Government of Kenya has identified the need for private sector investment into safe, affordable student housing to ensure that students are able to achieve the best educational outcomes.

Overview

Solution

InfraCo Africa is working with pioneering property developer and manager Acorn Holdings Ltd (Acorn) to scale the company’s delivery of high quality purpose-built student accommodation in Nairobi.

Acorn is seeking to tap into local capital markets to support its ambitious growth strategy. To do so, it has launched two Real Estate Investment Trusts (REITs) – a Development REIT to support housing under construction, and an Income REIT for stabilised operational housing blocks. Unlike traditional equity, REITs offer a tax efficient means of raising capital, enabling Acorn to scale quickly. However, the local capital markets have suffered from a number of market failures in recent years, making investors wary of new issuances. As an anchor investor into both the Development and Income REITs, InfraCo Africa’s involvement will give comfort to local private sector investors, crowding in further funds from investors such as pension and mutual funds.

The Acorn Affordable Student Housing project will phase delivery of 11 purpose-built housing blocks in Nairobi. The buildings will comply with IFC EDGE (Excellence in Design for Greater Efficiencies) standards for green building, reducing their environmental impact by at least 20%. The majority of construction materials will be sourced domestically.

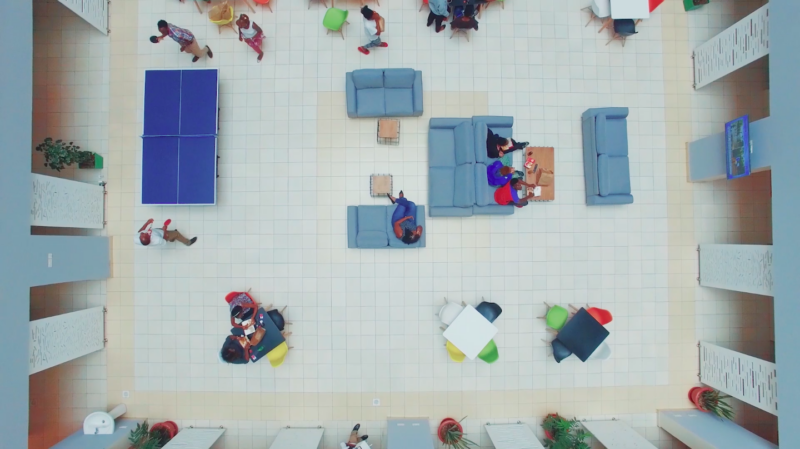

Once built, the housing blocks will provide 8,800 additional student beds over the next 5 years, a significant step towards addressing the current shortfall in the Kenyan capital. The accommodation blocks will provide a mix of studio apartments and rooms with shared kitchen and bathroom facilities to enable students with a range of income levels to access suitable housing. The accommodation will provide all students with access to 24 hour electricity, wi-fi, clean water and sanitation as well as social areas, gym access and safe transport to nearby colleges and universities. Security will be paramount with CCTV in operation and students accessing their blocks and rooms via biometric access cards. Acorn continues to develop tailored solutions to ensure safety and well-being of women students, contributing to SDG 5 Gender Equity. Female housekeeping and security staff will be employed to ensure that women feel safe in their student housing.

As part of the company’s commitment to deepening the participation of retail investors in the Kenyan capital markets, the Capital Markets Authority of Kenya has admitted Acorn’s recently launched Vuka investment platform, a product which aggregates qualified retail investors to invest in the Income REIT, to the regulatory sandbox scheme for testing. If successful, the Vuka platform will be the first of its kind in Kenya, offering retail investors access to asset backed and regulated investments.

By supporting Acorn to scale its offering, InfraCo Africa will enable more students to access safe, affordable housing for the duration of their studies. The initiative is expected to act as a catalyst for investment into student accommodation and to demonstrate that REITs can offer a credible funding source for the wider affordable housing sector. Once operating at scale, Acorn plans to list the Income REIT on the Nairobi Stock Exchange (NSE), deepening and widening the NSE’s product offering which, it is anticipated, will support other affordable housing initiatives in the future.

Being developed by Acorn Holdings Ltd.